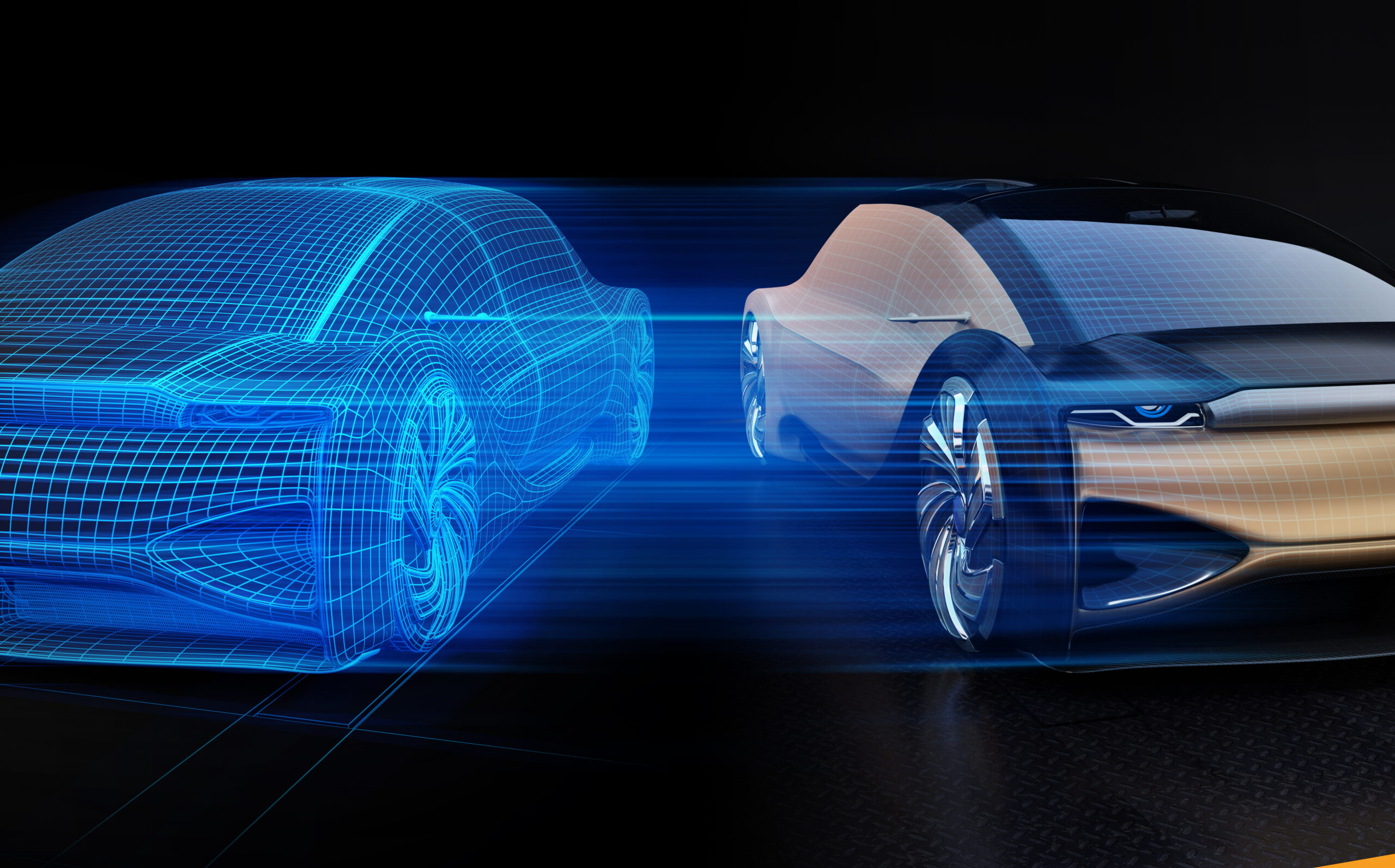

The movement to create the next generation of electric vehicles (EVs) and develop the complex infrastructure needed to influence mass adoption is picking up speed. Fuelled by tremendous industry growth, many of the world’s biggest automakers are putting EVs solidly at the forefront of their strategic road maps with a growing list of electrified additions joining their fleets. With international sustainability efforts calling for reductions in CO2 emissions, the EV mobility sector is at the threshold of major change.

A year of milestones for EVs

We are witnessing an exciting time in the history of EVs, but delivering electrification to the automotive sector began long before Tesla entered the scene. EVs go back further than many realise with electric vehicle prototypes being developed in the early 19th century. Things have progressed more rapidly over the past decade, with momentum continuing to build in China, the U.S. and Europe, despite the many challenges facing the global manufacturing and transportation industries today.

The Covid-19 pandemic hit the automotive world particularly hard, causing a 16% drop in vehicle production globally in 2020. Yet despite the enormous disruptions faced by OEMs, the market for electric vehicles has continued to grow with a 43% increase over 2019 – surpassing 10 million EVs on the roads worldwide. The Volkswagen Group, for instance, more than doubled its EV sales in the first half of 2021 – up over 165% compared to last year. This includes the company’s popular ID.4 range, equipped with Cubic Telecom’s connected software technologies. Stellantis – the world’s fourth-largest automaker with 14 brands under its umbrella – expects to have 55 electrified vehicles in the U.S. and Europe by 2025, with plans to invest at least $35.5 billion in vehicle electrification. These milestones are clear indicators that customer demand for EVs is not only rising, but growing faster than many had anticipated.

Challenges and opportunities

Before electric vehicles can go mainstream, there are various challenges that must first be addressed. One of the most pressing is the development of a viable charging infrastructure that can support the growing number of EVs on the roads. As of now, Tesla boasts the most sophisticated ‘supercharging’ network in the world that only its customer base can utilise, but the EV trailblazer is making waves with plans to open its stations to other types of electric vehicles this year. This is a big deal as the company moves to monetise its expanded services while giving competing EV manufacturers access to its coveted fast-charging stations.

In the near term, another serious issue that may slow the growth of the global automotive market is battery scarcity. While the cost of EVs are dropping closer to the levels of their gas-guzzling counterparts (thanks in part to cheaper batteries), shortages are expected to become more common as OEMs compete for resources amidst pandemic-related disruptions and delays. But in the face of significant hurdles, the EV marketplace has shown its resiliency and ability to adapt.

Norway is perhaps one of the best examples of what might be achievable, as nearly three-quarters of all cars sold in the country in 2020 were electric. By 2025, it aims to become the first nation on the planet to end the sale of petrol and diesel cars. As the global EV market continues to mature, the path will be strengthened towards a goal of zero emissions across electric mobility modes.

Read more: ‘Car of the Future’ Industry Trends