Dramatic changes underway across the automotive landscape—centred on rapidly evolving business models, next-gen autonomous technologies, electrification and an industry-wide push towards sustainability and the zero-carbon car—will usher in a transformative decade that will redefine our perception of the mobility experience. All converging players in this ecosystem including OEMs, tech innovators, government regulators and consumers will play a vital part in how these changes unfold, and which components become widely adopted.

These were some of the overarching themes at last week’s virtual Reuters Events: Car of the Future conference, which brought together some of the industry’s most influential voices to share their insights and strategies on the path forward. Here is a roundup of trends on the horizon:

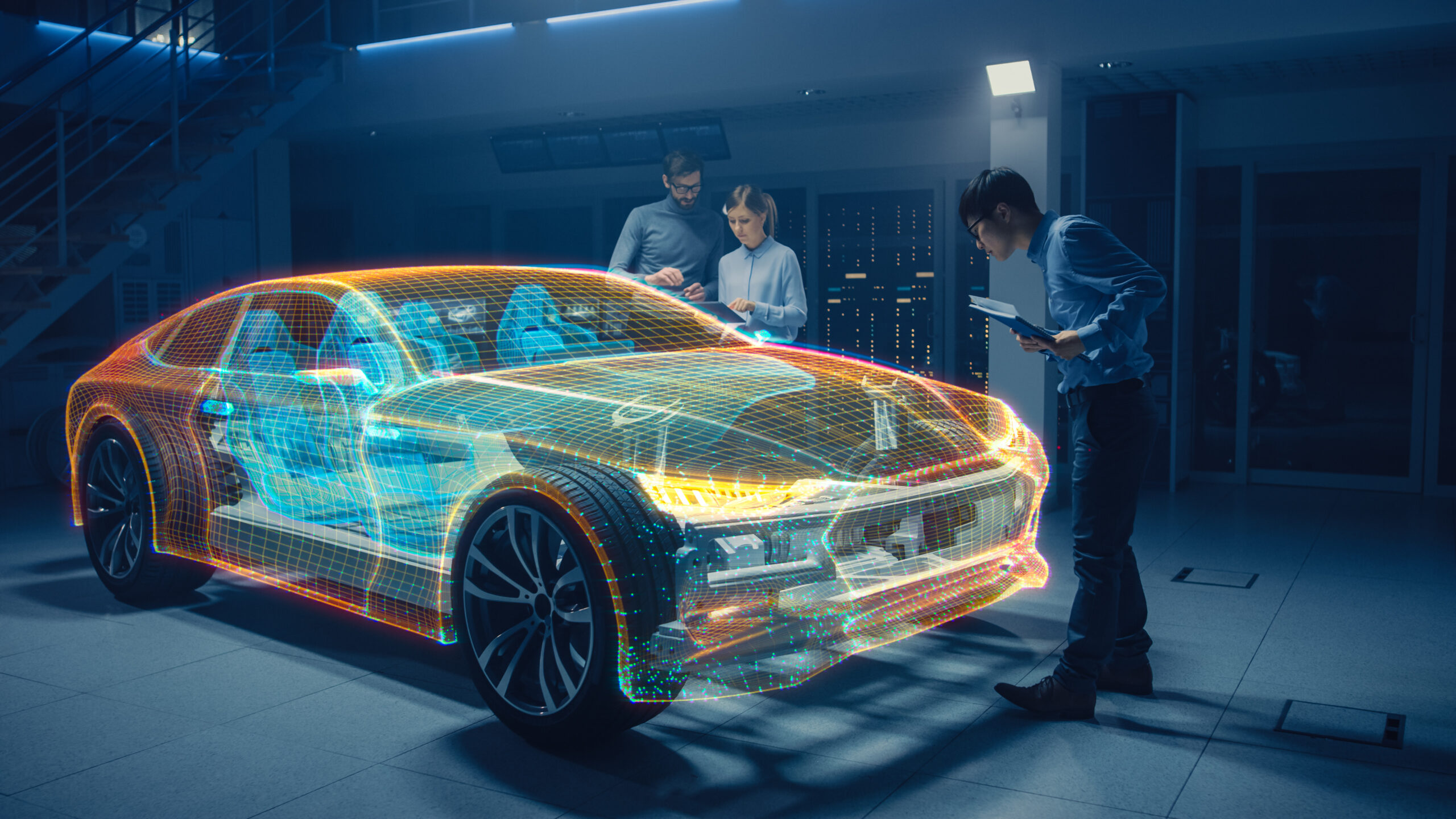

OEMs’ digital transformation

The convergence of connected cars, autonomous driving platforms, shared and electric mobility are disrupting the industry faster than ever—but will it be a revolution or evolution? With the onset of software-defined digitalisation impacting the entire automotive value chain, the challenge for OEMs is to avoid the trap of moving too slow, or worse, being left behind as new players enter the space and fill market gaps. According to Henrik Green (Volvo), OEMs must build products that will fit in this new world while anticipating the solutions needed for tomorrow. As a new set of expectations are defined by consumers, reducing complexity will be key to delivering connected vehicles as the new standard.

An electrified future

As EV sales continue to grow—particularly in booming markets like Europe and China, which boasts 44% of all the EVs in the world (more than 4.5 million)—calls to prepare EVs for the mainstream are growing louder. But challenges remain for mass market adoption, mainly due to the lack of sophisticated charging infrastructures and public awareness, with some drivers still holding the impression that EVs are more expensive than their gas guzzling counterparts. Fabrice Cambolive (SVP, Renault) expects plug-in hybrid vehicles to be a major part of the transition, particularly for winning over new customers. According to research firm, JD Power, most electric vehicle drivers vow to never return to combustion engines, with 82% considering purchasing another EV in the future. “Once you go EV, you don’t go back” has indeed become a familiar anthem that is resonating across the industry.

Data monetisation trends

The big data market in the automotive industry is expected to reach $7.84 billion globally by 2025—extracting value from this data has become a priority for all involved. Barry Napier (CEO, Cubic Telecom) put a spotlight on how OEMs can monetise connected vehicle data successfully to pull ahead in a field of growing competitors. By 2030, about 95% of new vehicles sold globally will be connected—that marks an increase from around 50% today. This will open up untapped opportunities for OEMs to make strategic decisions that ultimately put user-centric services and applications at the centre of their business models.

The road to full automation

Ever since sci-fi writers began giving creative licence to what a fully autonomous future might look like, there has been a constant question of ‘”when?” Today, the technologies are already in place and major investment is flowing—the autonomous vehicle market is projected to surpass $65 billion by 2027. Sajjad Khan (Mercedes-Benz AG) notes that the way to approach autonomy is to start on the highways. In fact, self-driving trucks are making the most progress today towards commercial deployment. This autonomous wave sweeping the logistics industry may offer the best glimpse yet of what’s to come.

Industry challenges remain on the road to developing tomorrow’s vehicle. Safety, data privacy and cyber security will be a top priority, as will the integration of 5G technologies. Key to its success will be the cooperation of private and public sector players, and a stronger push from government actors to begin laying out regulatory structures that will encourage more investment and build consumer confidence.

Get more insights on how OEMs can monetise data from the ‘car of the future‘